You’ve found several Chinese diesel generator manufacturers who seem legitimate. Their certifications check out, their factories look professional, and their references are positive. But their price quotes vary wildly—from $25,000 to $55,000 for what appears to be similar 500 kW units.

What’s going on? Are the cheaper ones cutting corners, or are the expensive ones overcharging?

Understanding diesel generator pricing from Chinese suppliers isn’t just about finding the lowest number. It’s about recognizing what drives those numbers and determining which costs represent real value versus which are unnecessary premiums or dangerous shortcuts.

After working with generator procurement for more than a decade, I can tell you that price differences always tell a story. Learning to read that story will save you from costly mistakes and help you identify genuine value.

The Anatomy of a Diesel Generator Price

Let’s start by breaking down what you’re actually paying for when you buy a diesel generator from China.

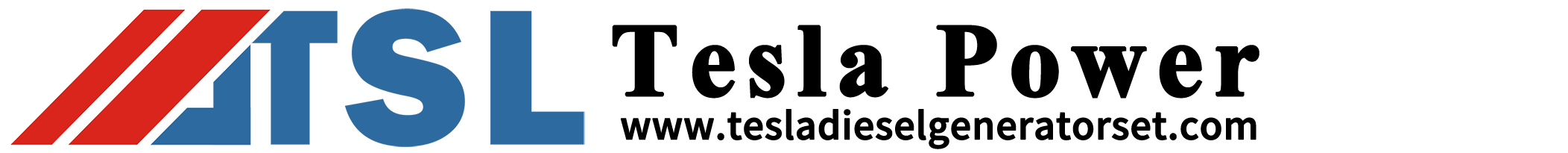

A typical industrial diesel generator price consists of several major components, each subject to different market forces and supplier decisions.

Engine cost (40-60% of total) – The engine is by far the largest cost component. A genuine Cummins or Perkins engine commands significantly higher prices than a Chinese-made alternative. For a 500 kW generator, the engine alone might cost $15,000-30,000 depending on brand and specifications.

Alternator cost (15-25% of total) – Quality alternators from Stamford, Marathon, or Leroy-Somer add substantial cost but deliver reliable power generation with better voltage regulation and longer service life.

Control systems (5-10% of total) – Modern digital control panels with remote monitoring capabilities cost significantly more than basic analog controllers. Deep Sea Electronics (DSE) or ComAp controllers are industry standards but add $1,000-3,000 to the package.

Base frame, fuel tank, and enclosure (10-20% of total) – The physical structure varies from basic open-frame designs to sophisticated weatherproof enclosures with soundproofing. An industrial-grade silenced canopy can add $5,000-15,000.

Manufacturing labor and overhead (5-10% of total) – Chinese labor costs remain competitive globally, but quality-focused manufacturers invest more in skilled workers and rigorous processes.

Profit margin (10-20% of total) – Margins vary based on manufacturer scale, market positioning, and competitive pressures.

When you see a $25,000 quote versus a $55,000 quote for “the same” generator, you’re almost certainly not looking at the same components or manufacturing quality. The differences are hidden in the details.

Factor 1: Engine Brand and Specifications

Nothing impacts price more dramatically than engine selection.

Premium tier engines like Cummins, Perkins, MTU, and Volvo Penta command the highest prices. These manufacturers have spent decades engineering reliability, efficiency, and global service networks. A Cummins QSX15-G9 engine for a 500 kW generator might cost a Chinese manufacturer $28,000-32,000—more than the entire selling price of some cheap alternatives.

Mid-tier engines from manufacturers like Deutz, Doosan, or Chinese-foreign joint ventures offer respectable performance at lower cost, typically 30-50% less than premium brands.

Chinese domestic engines from brands like Shangchai, Weichai, or Yuchai can be 60-70% cheaper than Cummins. Some are actually quite good, especially recent models. Others have reliability issues, higher fuel consumption, and limited international service support.

Here’s what many buyers don’t realize: engine specifications matter as much as brand. A Perkins 2806-PWT rated for prime power applications costs more than the same engine model configured for standby-only operation. Prime-rated engines are built for sustained continuous operation; standby engines are designed for occasional emergency use.

Manufacturers sometimes quote standby-rated engines for applications that require prime power operation. This saves them money while potentially setting you up for premature failure. Always verify the engine rating matches your intended duty cycle.

Tesla Power transparently lists engine brands and specific model numbers in their quotations, along with whether units are prime or standby rated. This transparency should be standard, but unfortunately it isn’t always.

Factor 2: Alternator Quality and Technology

The alternator converts mechanical energy from the engine into electrical power. Its quality determines power quality, efficiency, and longevity.

Premium alternators from Stamford (UK), Marathon (US), or Leroy-Somer (France) use high-grade copper windings, precise bearings, and sophisticated voltage regulation. They typically cost $5,000-15,000 depending on size and features.

Mid-tier alternatives from manufacturers like Mecc Alte (Italy) or Chinese-foreign joint ventures offer good performance at 20-40% lower cost.

Budget alternators from purely domestic Chinese manufacturers might save 50-70% but often have:

- Lower efficiency (converting less mechanical energy to electrical power)

- Poorer voltage regulation (potentially damaging sensitive equipment)

- Shorter operational life

- Less reliable performance under challenging conditions

Alternator technology matters too. Brushless self-exciting alternators cost more than brush-type but require less maintenance and provide better reliability. Permanent magnet generators (PMG) offer superior voltage regulation but add to cost.

For standby power solutions in critical facilities like hospitals or data centers, the additional cost of premium alternators is almost always justified. For less critical applications, mid-tier components might offer better value.

Factor 3: Certifications and Compliance

Certifications aren’t just documentation—they represent real costs in engineering, testing, and compliance.

ISO 8528 certification requires that manufacturers design and test generators to specific international standards. This involves investment in test equipment, documentation systems, and periodic audits. These costs get passed to buyers, typically adding 5-10% to base prices.

Emission compliance significantly impacts cost. Generators meeting EPA Tier 4 Final or EU Stage V emission standards require additional exhaust treatment systems:

- Diesel particulate filters (DPF)

- Selective catalytic reduction (SCR) systems

- Diesel exhaust fluid (DEF) injection systems

These emission control technologies can add $10,000-30,000 to generator costs, but they’re increasingly required in regulated markets.

CE marking for European markets requires specific safety features, documentation, and third-party testing. Budget manufacturers may claim CE compliance without actually holding proper certifications, creating legal risks for buyers.

UL listing for North American markets involves extensive testing and certification processes that smaller manufacturers often skip to save costs.

Manufacturers who’ve invested in comprehensive certification portfolios charge more—but they’re also the ones whose equipment will clear customs without issues and operate legally in regulated markets.

Factor 4: Manufacturing Quality and Processes

Two factories can assemble identical components and produce generators with dramatically different reliability. The difference lies in manufacturing processes.

Quality-focused manufacturers invest in:

- Precision assembly fixtures ensuring proper alignment

- Torque-controlled fastening equipment

- Multi-stage inspection protocols

- Factory acceptance testing (FAT) with actual load bank testing

- Clean, climate-controlled assembly environments

- Skilled, trained assembly technicians

Budget manufacturers often cut these corners:

- Manual assembly without precision fixtures

- Visual inspection only, no load testing

- Limited training for assembly workers

- Production in non-climate-controlled environments

The cost difference might be 15-25%, but the reliability difference can be enormous. A generator assembled with precision will outlast a sloppily-built unit by years, even with identical components.

When Tesla Power tests every generator at full load before shipping, that testing consumes fuel, equipment time, and labor hours. Those costs appear in the price—but they also mean you receive equipment that’s proven functional rather than gambling on assembly quality.

Factor 5: Customization and Features

Standard models cost less than customized configurations. Every special requirement adds both engineering time and component costs.

Common customization factors affecting price:

Enclosure and soundproofing – An open-frame generator costs significantly less than a fully enclosed, weatherproof, sound-attenuated unit. Sound levels below 75 dB(A) at 7 meters require sophisticated acoustic engineering and materials, potentially adding $10,000-20,000 for large units.

Automatic transfer switches (ATS) – Sophisticated ATS systems that automatically switch between utility power and generator power cost $2,000-10,000+ depending on current rating and features.

Synchronization and paralleling – Generators configured to operate in parallel require additional control systems and synchronizing equipment, adding $3,000-8,000 per unit.

Cold weather packages – Block heaters, battery warmers, and cold-start systems for arctic operation add $1,500-5,000.

Tropical packages – Enhanced cooling, corrosion-resistant coatings, and humidity protection for extreme climates add $2,000-6,000.

Extended fuel tanks – Doubling standard fuel capacity for longer runtime between refills adds significant weight, space, and cost.

Every requirement beyond the standard configuration adds cost. Be clear about which features you truly need versus nice-to-have options.

Factor 6: Order Volume and Business Relationship

Chinese manufacturers typically offer volume discounts, but the breakpoints might surprise you.

Single-unit orders receive list prices with minimal flexibility. The manufacturer has high per-unit costs for sales effort, customization, and logistics.

Small batch orders (2-5 units) might unlock 5-10% discounts as setup costs are amortized across multiple units.

Volume orders (10+ units) can command 15-25% discounts, especially if specifications are standardized.

Long-term partnerships with repeat orders receive the best pricing. Once a manufacturer understands your requirements and trusts your payment reliability, they’re motivated to maintain the relationship with competitive pricing.

I worked with a mining operation that initially paid premium prices for their first three generators. After two years of successful partnership and repeat orders totaling 20+ units, the same manufacturer’s pricing decreased by 22% while maintaining identical specifications. The relationship value worked both ways.

Factor 7: Currency Exchange and Payment Terms

International transactions introduce financial variables that affect final costs.

Currency exchange rates fluctuate constantly. A generator quoted at ¥200,000 RMB costs $27,400 at an exchange rate of 7.30 RMB/USD but $28,600 at 7.00 RMB/USD. Over large orders, these fluctuations are significant.

Many manufacturers prefer to quote in USD to stabilize their own planning, but some quote in RMB. Understand which currency your quote uses and what exchange rate assumptions are built in.

Payment terms dramatically affect pricing:

- 100% advance payment (before production): Manufacturers offer best prices but buyers assume maximum risk

- 30/70 split (30% deposit, 70% before shipping): Common compromise balancing risks

- Letter of credit (L/C): Adds bank fees but provides security; manufacturers often add 2-5% to cover their financing costs and complexity

- Open account terms (payment after delivery): Only available to established customers; virtually never offered on first orders

Manufacturers price these payment structures differently because they represent different cash flow and risk profiles. Expecting L/C terms at 100%-advance-payment prices is unrealistic.

Factor 8: Logistics and Shipping Considerations

The factory gate price is just the beginning. Understanding total landed cost requires factoring in logistics.

Incoterms define who pays for what in international shipping. Common terms and their implications:

EXW (Ex Works) – Buyer handles everything from the factory gate. Lowest quoted price but maximum logistics complexity and cost for buyers.

FOB (Free On Board) – Manufacturer delivers to the ship; buyer pays ocean freight and all costs beyond. This is extremely common in China trade.

CIF (Cost, Insurance, Freight) – Manufacturer pays ocean freight and insurance to destination port; buyer handles import clearance and inland delivery. Often the easiest for buyers to compare apples-to-apples.

DDP (Delivered Duty Paid) – Manufacturer handles everything to your door, including customs and duties. Most expensive but simplest for buyers.

For a 500 kW generator shipping from Shanghai to Los Angeles, the cost difference between EXW and DDP pricing might be $5,000-8,000. When comparing quotes, verify which Incoterms apply.

Shipping also depends on packaging. A basic wooden crate costs less but provides minimal protection. A fully engineered shipping container with shock-absorbing mounts and weatherproofing costs more but ensures your generator arrives undamaged.

Factor 9: Warranty Coverage and After-Sales Support

Warranty terms directly correlate with price because they represent ongoing manufacturer obligations.

Standard warranties in China’s generator industry are typically:

- 12 months from delivery date, or

- 1,000 operating hours, whichever comes first

Extended warranties (24-36 months) cost extra because manufacturers must reserve funds for potential claims and factor in statistical failure rates.

But warranty duration alone doesn’t tell the whole story. Read the fine print:

Comprehensive coverage includes both parts and labor, return shipping for defective components, and travel expenses for on-site repairs if needed. This is expensive for manufacturers, especially for international customers.

Limited warranties might cover parts only (you pay labor), exclude certain components (batteries, minor wear items), or require you to ship defective parts back to China at your expense.

Conditions and exclusions matter enormously. Warranties often exclude damage from improper installation, maintenance neglect, or operating outside specifications. Some manufacturers void warranties if you use non-OEM parts or don’t follow strict maintenance schedules.

Manufacturers offering comprehensive warranties price them higher because they’re accepting real risk. Cheap quotes with seemingly identical warranty periods often have exclusions that make them nearly worthless.

Quality manufacturers like Tesla Power back their warranties with responsive international service networks and genuine commitment to customer success, not just contractual minimums.

Factor 10: Manufacturer Positioning and Brand Premium

Some Chinese manufacturers charge premium prices based on reputation, track record, and market positioning.

Export specialists with decades of international experience and established customer bases can command 10-20% premiums over domestic-focused competitors. They’ve invested in English-speaking sales and support teams, international certifications, and proven quality systems that justify higher pricing.

OEM suppliers to major global brands often maintain higher pricing when selling under their own name because they’re applying the same quality standards they use for premium customers.

Newer market entrants aggressively price products to build market share and customer base. This can create genuine value opportunities if you thoroughly vet their capabilities—but aggressive pricing can also indicate unsustainable business models or quality shortcuts.

Don’t automatically dismiss manufacturers charging 15-20% above market average if their certifications, references, and capabilities justify the premium. Conversely, don’t assume the most expensive option is necessarily the best—some manufacturers simply operate with higher overhead or profit expectations.

Comparing Quotes: An Example Breakdown

Let’s examine two actual quotes for a 500 kW generator to see how these factors play out:

Quote A: $28,500 (FOB Shanghai)

- Engine: Weichai WP13 series (Chinese brand)

- Alternator: Chinese domestic brand

- Controller: Basic digital controller (Chinese)

- Enclosure: Open frame, basic rain cover

- Certifications: ISO 9001 only

- Warranty: 12 months parts, customer pays labor and shipping

- Testing: Visual inspection, no load testing

Quote B: $54,800 (FOB Shanghai)

- Engine: Cummins QSX15-G9 (premium brand, prime power rated)

- Alternator: Stamford HCI544 (UK premium brand)

- Controller: Deep Sea Electronics 8610 (advanced features, remote monitoring)

- Enclosure: Fully enclosed, sound-attenuated (75 dB@7m)

- Certifications: ISO 9001, ISO 14001, ISO 8528, CE, EPA Tier 3

- Warranty: 24 months comprehensive (parts, labor, return shipping included)

- Testing: Full load bank testing at 100% for 4 hours

The price difference is 92%, but these aren’t remotely the same product. Quote B uses components costing 70-80% more, includes $8,000+ worth of acoustic enclosure, carries comprehensive certifications, and provides a warranty worth potentially $5,000-10,000 in actual coverage.

For a critical application where reliability is paramount, Quote B offers far better value despite the higher sticker price. For a non-critical backup application where low initial cost is the priority, Quote A might be appropriate—if you understand the compromises.

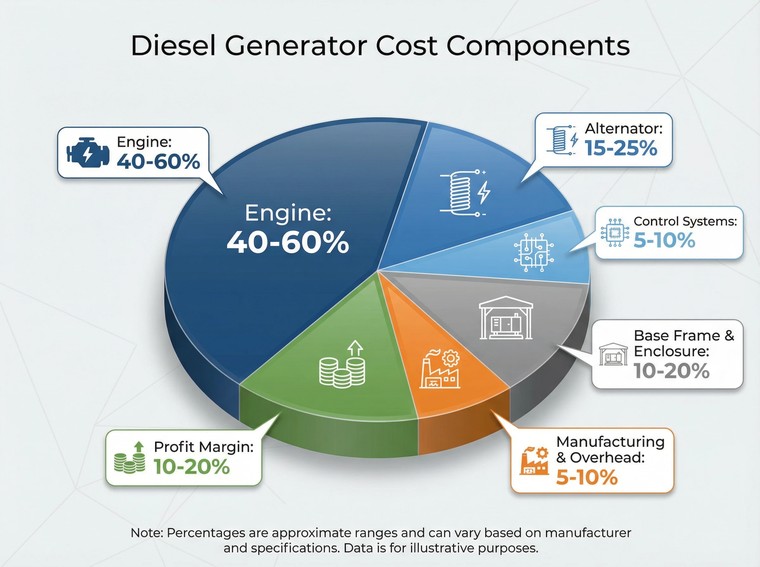

Hidden Costs That Affect Total Ownership

Purchase price is just one element of total cost of ownership (TCO). Smart procurement managers evaluate:

Fuel consumption – Generator fuel efficiency varies significantly based on engine technology. A generator consuming 15% more fuel than a more efficient alternative will cost you thousands of dollars extra annually in fuel costs. Over 20 years of operation, this can exceed the initial purchase price difference.

Maintenance frequency and costs – Lower-quality generators often require more frequent maintenance. If a budget generator needs service every 200 hours versus 500 hours for a premium unit, maintenance costs multiply quickly.

Parts availability and pricing – Generators built with common components from major brands have competitive parts markets and global availability. Proprietary components from obscure manufacturers mean you’re locked into expensive, hard-to-source parts with long lead times.

Downtime costs – For critical applications, every hour of downtime has a real cost. A hospital losing power or a data center going offline loses far more than generator repair costs. More reliable (typically more expensive) generators minimize these risks.

Resale value – Quality generators from reputable brands retain significant value. Budget no-name generators have virtually no resale market.

Strategies for Getting the Best Value

How do you navigate this complexity to get the best value, not just the lowest price?

Define your requirements precisely – Create detailed specifications covering power output, duty cycle (prime vs standby), environmental conditions, noise limitations, emission requirements, and critical features. Vague requirements lead to quote variations that are impossible to compare.

Request itemized quotes – Ask manufacturers to break down costs by major component. This reveals where price differences originate and helps you understand value propositions.

Compare apples to apples – Insist that all quotes use the same Incoterms, include the same testing protocols, and specify exact component brands and models. Only then can you meaningfully compare prices.

Evaluate total cost of ownership – Calculate fuel costs, maintenance expenses, and downtime risks over your planning horizon, not just purchase price.

Negotiate strategically – Don’t just ask for lower prices—understand what manufacturer costs are flexible. Volume commitments, flexible delivery timing, simplified specifications, and favorable payment terms can all unlock price improvements.

Consider long-term relationships – If you have ongoing generator needs, communicate that to manufacturers. The prospect of repeat business motivates better pricing and service.

Don’t over-specify – Paying for EPA Tier 4 Final compliance when you’re operating in an unregulated market wastes money. Match specifications to actual requirements.

Don’t under-specify – Skimping on critical features like adequate soundproofing, proper emission controls, or reliable components to save 15% upfront often costs you multiples of that in operation.

Red Flags in Pricing

Certain pricing patterns should trigger additional scrutiny:

Prices far below competitors – If one quote is 30%+ below others for supposedly identical specifications, something is wrong. Either components are substituted, quality is compromised, or it’s a bait-and-switch scheme.

Vague or incomplete quotes – Quotes that don’t specify exact engine and alternator brands and models, don’t clarify Incoterms, or are ambiguous about testing and warranty terms are red flags.

Prices that “expire” immediately – Legitimate manufacturers provide quotes valid for 30-90 days, accounting for reasonable customer decision-making time. Pressure tactics suggesting prices are only valid for 24-48 hours are sales manipulation.

Significant price changes after deposit – Some unscrupulous suppliers quote low to secure deposits, then claim “miscommunication” and demand higher payments before shipping. This is outright fraud. Use detailed contracts and secure payment methods.

Unusually high shipping quotes – Some manufacturers offer competitive equipment prices but inflate shipping costs with excessive margins. Always verify shipping quotes against independent freight forwarder estimates.

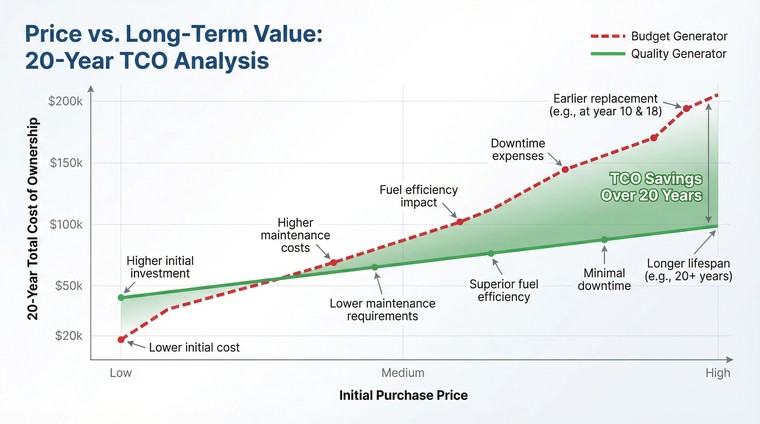

Questions to Ask When Evaluating Quotes

Arm yourself with these questions when comparing diesel generator prices:

- What specific engine brand and model are you quoting? Is it prime or standby rated?

- What specific alternator brand and model is included?

- What controller brand and model is included? What monitoring capabilities does it have?

- Which certifications do you hold, and can you provide certificate numbers for verification?

- What Incoterms apply to this quote?

- Exactly what does the warranty cover (parts, labor, shipping)? What are the exclusions?

- What testing will be performed before shipment? Will you provide test certificates?

- What is your typical lead time from order to shipment readiness?

- What technical support do you provide after installation? How do I reach support?

- Can you provide references from customers in my region who purchased similar equipment?

Reputable manufacturers will answer all these questions clearly and completely. Evasive or vague responses are warning signs.

Negotiation Tactics That Work

When you’ve selected your preferred manufacturer but want better pricing, these strategies often work:

Volume commitments – Even if your immediate need is three units, mention potential for 10-15 units over the next 24 months. Future business potential motivates current concessions.

Flexible timing – Manufacturers often have capacity cycles. Ordering during slower periods (after Chinese New Year, typically Q1) can unlock better pricing than peak seasons.

Simplified specifications – Reducing customization, standardizing configurations, or eliminating non-critical features can reduce costs meaningfully.

Payment term adjustments – If you can offer more favorable payment terms (larger deposit, faster payment), manufacturers may reduce prices.

Multi-product opportunities – If you need other equipment (pumps, compressors, etc.) that the manufacturer or their partners supply, bundled purchases create leverage.

Long-term maintenance contracts – Some manufacturers offer pricing discounts if you commit to purchasing spare parts and maintenance services from them.

What doesn’t work:

- Simple demands for discounts without justification

- Lying about competitor prices

- Playing manufacturers against each other without genuine consideration of their offers

- Expecting charity pricing while demanding premium service

Chinese business culture values relationships and mutual benefit. Approach negotiations as partnership building, not adversarial bargaining.

Frequently Asked Questions

Why do diesel generator prices from Chinese manufacturers vary so much for similar specifications?

Price variations reflect differences in component quality (engine and alternator brands), manufacturing processes, certification compliance, warranty coverage, and included features. A quote $20,000 below another isn’t offering the same product—it’s using cheaper components, less rigorous manufacturing, or more limited warranty coverage. Always compare detailed specifications, not just power ratings, to understand what drives price differences. The cheapest option rarely delivers the best value when you factor in reliability and total cost of ownership.

What’s a reasonable price range to expect for industrial diesel generators from China?

Quality industrial diesel generators from reputable Chinese manufacturers typically cost $50-100 per kW for units under 500 kW, and $40-80 per kW for larger units. These ranges assume quality components (recognized engine and alternator brands), proper certifications, adequate testing, and reasonable warranty coverage. Prices significantly below this—say $30-40 per kW—almost certainly involve compromises in components or manufacturing quality. Prices above $100 per kW might include premium features, extensive customization, or manufacturer brand premiums.

How much should I budget beyond the purchase price for shipping and import costs?

Budget 15-25% of FOB price for complete landed costs to most destinations. This includes ocean freight (5-10% of generator value), marine insurance (0.5-1%), import duties (0-10% depending on destination country), customs clearance fees ($300-800), and inland transportation to final site (highly variable by distance). For a $40,000 generator FOB Shanghai, expect total landed costs of $46,000-50,000 to a North American or European location. CIF or DDP quotes from manufacturers eliminate this calculation uncertainty.

Are payment terms negotiable with Chinese diesel generator manufacturers?

Yes, payment terms are negotiable, especially with established manufacturers seeking long-term relationships. First-time buyers typically face 30-50% deposit with balance before shipment, while some manufacturers accept letter of credit terms. As you build relationship history and demonstrate payment reliability, terms often improve to 30/70 splits or even open account terms for valued customers. More favorable payment terms for you may result in slightly higher pricing (1-3%) to offset the manufacturer’s financing costs and risk.

Should I always choose the generator with the most certifications even if it costs more?

Match certifications to your actual regulatory and operational requirements. If you’re operating in a region requiring CE marking or EPA Tier 4 compliance, those certifications aren’t optional—budget for them. If you’re in an unregulated market, paying extra for compliance you don’t need wastes money. However, ISO 8528 certification demonstrates manufacturing competence valuable anywhere, and ISO 9001 quality management certification provides process assurance. Don’t pay for every possible certification, but don’t skip core quality certifications to save 10% either.

Making the Smart Choice

Diesel generator pricing from Chinese suppliers reflects genuine differences in component quality, manufacturing processes, certifications, and service commitments—not arbitrary numbers.

The cheapest option is rarely the best value. The most expensive isn’t automatically superior. The sweet spot lies in understanding what you’re actually buying, matching specifications to your real requirements, and evaluating total cost of ownership rather than just purchase price.

Take time to request detailed, itemized quotes. Ask probing questions about components, testing, warranties, and support. Verify certifications independently. Check references thoroughly. Calculate operating costs over your planning horizon.

When you find a manufacturer offering transparent pricing, quality components, proper certifications, and genuine support commitment at fair market rates, you’ve found value worth paying for.

That investment in due diligence and appropriate pricing will repay itself many times over through reliable power, lower operating costs, and years of trouble-free operation.