Imagine this: It’s 2:00 AM, and a severe storm has just knocked out the main grid power to your manufacturing facility. Your backup system kicks in, but twenty minutes later, the engine sputters and dies. Silence. You scramble to call your supplier, only to get a voicemail. Or worse, you reach them, but they tell you the specific fuel injector you need is out of stock and has to be shipped from a warehouse three continents away—with a two-week lead time.

For facility managers and procurement officers, this is the ultimate nightmare. The hardware is only as good as the support behind it. When you are responsible for critical operations, you aren’t just buying a piece of equipment; you are investing in an insurance policy against downtime. This is why finding a diesel generator manufacturer with a true global service network is not a luxury—it is a strategic necessity.

In this guide, we will navigate the complex landscape of global power generation. We’ll look at where the top manufacturers are located, how to distinguish between a local assembler and a global OEM, and how to vet them to ensure that when the lights go out, your support team turns on.

Understanding Global vs. Local Manufacturers

Before you start scrolling through directories or visiting trade show booths, it is crucial to define what we actually mean by a “global service network.” A diesel generator manufacturer claiming global support doesn’t just mean they ship to other countries. Shipping is easy; support is hard.

A true global service network implies a decentralized infrastructure. It means the manufacturer has:

- Regional Parts Depots: Warehouses strategically located in North America, EMEA (Europe, Middle East, Africa), and APAC (Asia-Pacific) to ensure critical spares are never more than 24-48 hours away.

- Certified Training Centers: Facilities that train local technicians on the specific nuances of their engines and alternators.

- Standardized Protocols: Whether you call support in Dubai, Houston, or Singapore, the diagnostic process and warranty honorability should be identical.

The “Local Assembler” Trap

Many buyers confuse “local suppliers” with manufacturers. A local company might buy an engine from Brand A, an alternator from Brand B, and a controller from Brand C, then assemble them into a canopy.

- Pros: They are often cheaper and offer very personalized, face-to-face initial sales service.

- Cons: If the engine fails, the assembler might point you to the engine manufacturer’s warranty, who might then point you to a regional distributor who doesn’t know who you are. This “blame game” extends downtime.

The International OEM Advantage

Buying directly from a major international diesel generator manufacturer or their exclusive master distributor usually costs more upfront. However, the Total Cost of Ownership (TCO) is often lower because:

- Single-Source Responsibility: The entire commercial generator—engine, alternator, and cooling system—is supported by one entity.

- Firmware Updates: Modern generators are software-driven. Global OEMs push updates to optimize fuel efficiency and protection logic.

- Resale Value: Branded genset suppliers with global recognition hold their value significantly better on the secondary market.

Pro Tip: If your business operates in multiple countries, standardizing on one global manufacturer simplifies your parts inventory and maintenance training across all sites.

Top Regions and Manufacturing Hubs for Diesel Generators

The global map of diesel generator manufacturer hubs is distinct, with each region specializing in different aspects of power generation technology. Understanding these regional characteristics helps you align your choice with your specific needs.

1. North America (The Heavy-Duty Titans)

The United States and Canada are home to some of the oldest and most established names in the industry, such as Caterpillar, Cummins, and Kohler.

- Characteristics: North American units are renowned for their ruggedness and ability to handle massive load steps (shock loading). They are often over-engineered to survive harsh environments, from the Alaskan tundra to the Nevada desert.

- Regulatory Focus: Manufacturers here are driven by strict EPA (Environmental Protection Agency) Tier 4 Final emission standards. If you need backup power in a highly regulated zone, these are your go-to sources.

- Best For: Large data centers, hospitals, and heavy industrial mining operations where failure is not an option.

2. Europe (The Efficiency Experts)

Europe is the heart of precision engineering. Key players include Perkins (UK), Volvo Penta (Sweden), and MTU (Germany).

- Characteristics: European diesel generator manufacturer brands focus heavily on fuel efficiency, compact power density, and noise reduction. A 500kVA unit from a European brand is often physically smaller and quieter than its counterparts.

- Regulatory Focus: EU Stage V emission standards are currently the most stringent in the world for non-road mobile machinery, driving innovation in exhaust after-treatment systems.

- Best For: Urban construction sites, telecommunications, and commercial buildings where space and noise are constraints.

3. Asia (The Volume and Value Leaders)

Asia is a massive, diverse hub. It includes the high-tech precision of Japan (Yanmar, Mitsubishi, Kubota) and the manufacturing giants of China and India.

- Japan: Dominates the smaller (<100kW) market. Their engines are legendary for longevity in continuous duty applications like cell towers.

- China & India: This is where the bulk of the world’s standard industrial generators are produced. While quality varied historically, top-tier manufacturers have closed the gap with Western competitors.

- The Emerging Leaders: Companies like Tesla Power are excellent examples of this evolution. Leveraging robust manufacturing bases in Asia (specifically India) while adopting global quality standards, brands like Tesla Power offer a compelling balance between cost and reliability, backed by an expanding global service footprint.

- Best For: Cost-conscious projects, retail chains, and emerging markets where straightforward, mechanical reliable power is preferred over complex electronics.

Knowing where the manufacturers are is step one. Step two is knowing how to find the specific one that fits your procurement list.

How to Find and Vet Reliable Manufacturers

Finding a list of names is easy; finding the right partner requires a structured approach. You aren’t just looking for a vendor; you are looking for power equipment suppliers who can act as long-term partners. Here is a professional roadmap for locating and vetting top-tier manufacturers.

1. Specialized Online Directories

General search engines often clutter results with ads and irrelevant local resellers. instead, utilize industry-specific procurement platforms:

- ThomasNet (North America): Excellent for filtering manufacturers by certification (ISO 9001, UL) and location.

- DirectIndustry (Global): A virtual exhibition hall that categorizes genset suppliers by power output, fuel type, and region.

- Kompass (International): Great for verifying corporate data and checking if a “manufacturer” is actually just a trading company.

2. The Trade Show Circuit

There is no substitute for kicking the tires—literally. Industry trade shows allow you to meet the engineering teams and see the build quality firsthand.

- PowerGen International: The premier event for the power generation sector, usually held in the US.

- Middle East Energy (Dubai): A critical hub for sourcing industrial generators, bridging European technology with Asian manufacturing efficiency.

- Canton Fair (China): The place to find high-volume manufacturing partners, though thorough vetting is required here to separate premium OEMs from budget assemblers.

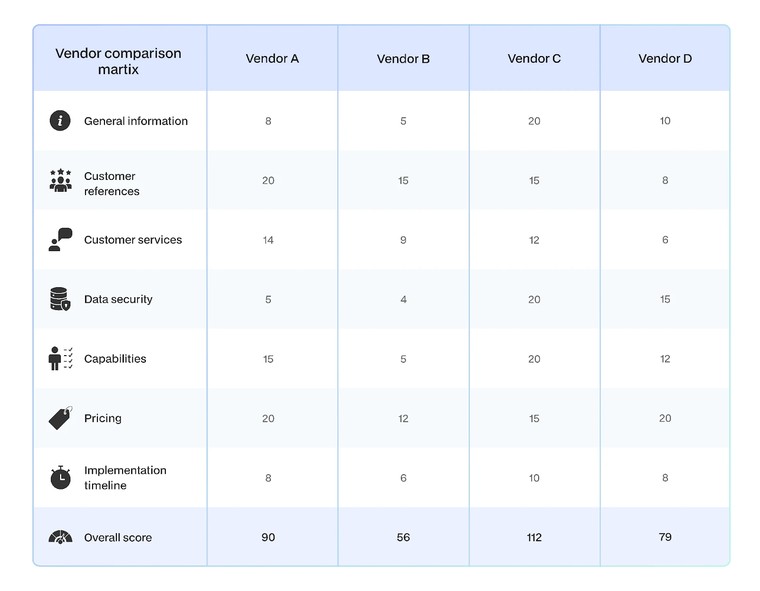

3. The Vetting Process: A Buyer’s Checklist

Once you have a shortlist, apply this rigorous vetting framework to minimize risk.

Phase 1: Verification

- Factory Acceptance Test (FAT) Capabilities: Can they perform a witness test at their factory? A manufacturer that welcomes you to watch your generator run at 100% load before shipment is confident in their product.

- BOM Transparency: Will they provide a detailed Bill of Materials? You need to know exactly what alternator and controller are under the hood.

Phase 2: The “Three-Reference” Rule

Ask for three client references, but be specific. Do not just ask for “happy customers.” Ask for:

- A client in your specific industry (e.g., healthcare, data center).

- A client in your specific region (to verify local support).

- A client who has owned the equipment for more than 5 years (to verify longevity).

Phase 3: Auditing the Local Dealer

The manufacturer might be a global giant, but your relationship will be with their local dealer. You must audit them separately.

- Technician Count: How many certified techs do they have per unit installed in the region?

- Service Fleet: Do they have fully stocked service trucks, or do they rely on third-party contractors?

- Autonomy: Does the local dealer have the authority to approve warranty claims, or must they wait for approval from headquarters abroad?

Evaluating Service Network Coverage

A diesel generator manufacturer might claim to have a “global service network,” but coverage is not binary—it’s a spectrum. As a buyer, you need to quantify the quality of that coverage. Here are the metrics that define a truly supportive network.

1. Response Time vs. Resolution Time

Sales brochures often tout a “24-hour response time.” Be careful. “Response” might just mean someone answers the phone. You need to ask about Resolution Time.

- The Question to Ask: “What is your standard Service Level Agreement (SLA) for an on-site technician arrival during an emergency?”

- The Benchmark: For critical backup power applications, a 4-hour on-site response SLA is the gold standard in major metropolitan areas.

2. Parts Availability (The “First-Time Fix” Rate)

The most frustrating expense in power generation is the “return trip” charge—when a technician arrives, diagnoses the problem, but has to leave because they don’t have the part.

- Global Logistics: Top manufacturers use predictive analytics to stock regional warehouses. For example, if they know they have 500 units of a specific engine model operating in Texas, their Dallas hub should automatically stock the appropriate number of fuel pumps and starter motors.

- Fill Rate: Ask prospective suppliers about their “parts fill rate.” Top-tier power equipment suppliers aim for 95%+ availability for critical consumables and wear parts.

3. Digital Integration and Remote Monitoring

In the modern era, service coverage isn’t just about vans and wrenches; it’s about data.

- Telematics: A robust global service network is now digital. Leading manufacturers offer remote monitoring systems that alert both you and the local dealer before a fault causes a shutdown.

- Over-the-Air Support: Some advanced controllers allow factory engineers to remotely dial into your generator to troubleshoot complex software issues, effectively bringing global expertise directly to your site instantly.

4. The “Orphan” Risk

Be wary of “private label” generators. Large retail chains sometimes rebrand generators under a house name. While the price is attractive, the service network is often nonexistent. If the retailer changes suppliers next year, you are left with an “orphan” machine that no local dealer wants to touch. Stick to established OEM brands where the support ecosystem is permanent.

Digital Resources and Trade Platforms

While physical inspections are vital, the initial search for power equipment suppliers begins online. However, the digital landscape is filled with noise. Here is how to use digital resources effectively to shortlist high-quality manufacturers.

Leveraging B2B Platforms

B2B marketplaces have evolved from simple directories into sophisticated vetting engines. When using platforms like Alibaba (for Asian markets) or MFG.com, do not just sort by price. Use the advanced filters to sort by:

- Transaction History: High transaction volumes usually indicate a stable supply chain.

- Verified Supplier Tags: These badges often mean a third-party inspection service (like SGS or Bureau Veritas) has physically audited the factory.

- Response Rate: A manufacturer that takes 48 hours to reply to a sales inquiry will likely take even longer to reply to a service request.

Manufacturer Websites and Portals

A manufacturer’s website is a window into their corporate soul. Look for these specific “trust signals”:

- Dealer Locator Tools: A functional, interactive map showing authorized service centers is the strongest evidence of a global service network. If the “Service” page is just a “Contact Us” form, be skeptical.

- Technical Library: Legitimate commercial generator OEMs provide public access to spec sheets, manuals, and warranty documents. If this information is gated or nonexistent, it suggests a lack of transparency.

- Case Studies: Look for project portfolios that match your scale. If you need a 2MW setup for a hospital, and their case studies only show 20kW home units, they are likely out of their depth.

Certification Databases

Don’t take a manufacturer’s word for it—verify their certifications independently.

- UL Database: Use the UL Product iQ™ database to verify safety certifications for North American markets.

- EGSA (Electrical Generating Systems Association): Membership in this trade association is a strong indicator of professional standing and adherence to industry codes.

Conclusion: The True Cost of a “Bargain”

Buying a diesel generator is not like buying office supplies; it is a capital expenditure that anchors your facility’s resilience. The market is flooded with genset suppliers offering unbeatable prices, but those savings evaporate the moment you face your first major outage with no support.

Finding a top diesel generator manufacturer with a global service network is about risk management. It requires looking beyond the sticker price to evaluate the infrastructure behind the iron. Whether you choose a heavy-duty North American titan, a precision European firm, or an emerging value leader like Tesla Power, the goal remains the same: to ensure that when the grid fails, your operations do not.

Invest in the network, not just the engine. Because in the world of critical power, the only thing more expensive than a premium generator is a cheap one that doesn’t work when you need it most.

FAQ: Frequently Asked Questions

1. Where are most industrial diesel generators manufactured today?

The manufacturing landscape has shifted significantly over the last two decades. While engines are still designed in engineering hubs in the US, UK, and Japan, the final assembly of industrial generators frequently occurs in modernized facilities in China, India, and Mexico. This global supply chain allows manufacturers to lower costs while maintaining quality through strict centralized quality control standards. The key is not just where the metal is cast, but where the quality assurance protocols are defined.

2. How can I verify a manufacturer’s “Global Service Network” claims?

Do not rely on marketing brochures. First, use the “Dealer Locator” tool on their website to see the actual density of service points in your region. Second, call a random listed dealer in your area and ask if they carry parts for that specific brand. Third, ask the manufacturer for a “Parts Availability Report” or fill-rate metrics for your specific region. A true global network will have verifiable, localized infrastructure, not just a sales office.

3. What are the best trade shows for finding legitimate manufacturers?

If you are serious about vetting power equipment suppliers, prioritize “PowerGen International” (typically in the USA) for a global overview. “Middle East Energy” in Dubai is fantastic for seeing a mix of European and Asian brands. For those looking specifically for high-volume Asian partners, the “Canton Fair” in Guangzhou is the largest, but requires the most careful vetting. “Hannover Messe” in Germany is also excellent for industrial technology and European engineering standards.

4. What is the difference between an OEM and a Generator Assembler?

An OEM (Original Equipment Manufacturer) designs and builds the core components—often the engine and alternator—and integrates them into a complete system. They own the technology and the warranty. An assembler buys an engine from Company A and an alternator from Company B, bolts them together, and puts their badge on it. OEMs generally offer better long-term support and simpler warranty processes, while assemblers might offer lower initial prices but disjointed support.

5. How do I assess the reliability of an international manufacturer I haven’t heard of?

Start by checking their certifications (ISO 9001, UL, CE). Then, look for their presence in major projects—do they have case studies for hospitals, data centers, or airports? Finally, look for brands that are bridging the gap, like Tesla Power, which combine cost-effective manufacturing bases with global service standards. If a brand has a growing dealer network and transparent technical documentation, they are often a safe and high-value alternative to legacy premium brands.